Offshore Account Can Be Fun For Everyone

Table of ContentsSome Ideas on Offshore Account You Should KnowThe smart Trick of Offshore Account That Nobody is Talking AboutThe smart Trick of Offshore Account That Nobody is DiscussingHow Offshore Account can Save You Time, Stress, and Money.Everything about Offshore Account

Depending on the jurisdiction you select, this company has partnerships with safe and secure overseas financial institutions that provide the utmost in security as well as security. Offshore banking or offshore banks refer to the lots of financial and also financial investment organizations.

The 2-Minute Rule for Offshore Account

Since their beginning, Offshore Banks, often tended to be unjustly represented by both media and the home territories alike. The allegations have varied from tax evasion to money laundering. Mindful take a look at the true purpose of Offshore Banking Accounts. After that do some impartial study to analyze where illegal funds are genuinely held or "laundered." This will shed some light on the situation.

Once again, these might not be farther from the reality. offshore account. Many Offshore Financial institution Account jurisdictions of any prestige have extremely innovative, secure financial laws. This is due to the fact that it is in their benefit to bring in and maintain depositors. The authorities gear these guidelines towards satisfying the demands of the depositor. A lot of these territories rely upon foreign funding kept in their financial institutions as their key economic variable.

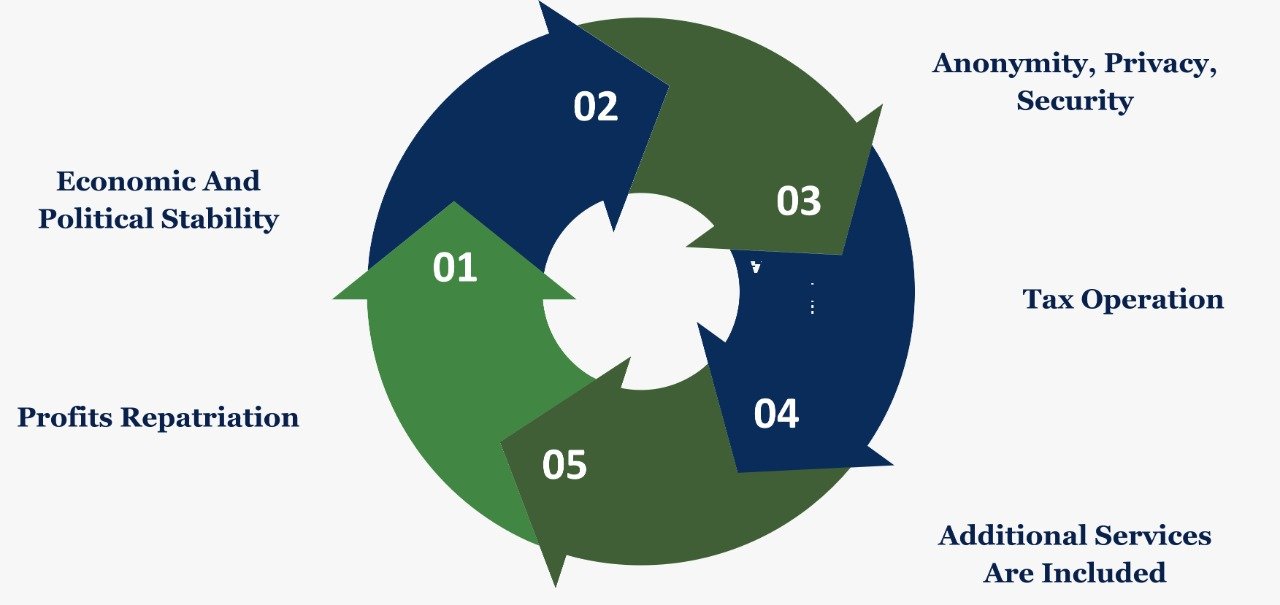

The broad meaning of an Offshore bank is a bank situated in a jurisdiction or country that is various from the jurisdiction or nation that the depositor or financier resides. One of the many advantages of holding an Offshore financial account is that they are typically situated in tax obligation sanctuaries.

The Facts About Offshore Account Revealed

These territories also usually allow for a leisure of limitations with respect to the types of offshore financial accounts. Thus, regulatory authorities dictate exactly how the bank handles and controls the funds for optimum depositor safety.

The more preferred offshore territories frequently provide a substantial decrease in tax obligation responsibility. These Offshore banks can be found in real island-states such as the Caymans or Channel Islands.

Switzerland has been a tax haven for over a a century as well as longer than the island countries. There has actually been much babble pertaining to the personal privacy of Swiss banks. You'll observe, nonetheless, the only Swiss financial institutions that have actually had concerns are those financial institutions with branches situated beyond Switzerland. Credit Scores Suisse and also UBS has significant United States visibility.

Indicators on Offshore Account You Should Know

Those with purely Swiss locations continue to maintain solid privacy. As pointed out in our opening paragraph, there moved here are a variety of misconceptions related to overseas savings account. Are Offshore Banks the Sanctuary of Money Launderers and also Crooks? Check out the financial pop over here misconceptions section on this web site for even more info. In this write-up, we have added info on Offshore Financial institution Account Misconceptions that must be taken right into consideration.

Most of the offshore jurisdictions have sensible, sound laws. offshore account. They are in location geared in the direction of protecting the down payments and also keeping their privacy. Some evaluate their advantages in taxation, while others in privacy, and also so forth. Though they all supply a fairly private and safe setting, it bears factor to consider to describe what the financial objectives are.

Below, you will see more info concerning these two popular jurisdictions. It is an unfortunate truth that Europeans have actually constantly been subjected to fairly heavy tax obligation concerns. This was as true on the British Isles as it was on the continent. Europeans were confronted with the prospect of viewing their tough made properties and also riches decrease.

Our Offshore Account PDFs

Therefore, the continent was ripe for a solution. After that an option came. The small, island nation state known as the Network Islands created a concept. They persuaded these distressed depositors that deposits put in its banks can be devoid of analysis; hence, the heavy-handed taxation problem. These benefits encouraged several well-off Europeans.

At the exact same time, the media has actually depicted foreign financial accounts unfairly. These high-tax nations and high-fee banks depict them as a veritable sanctuary for illicitly-obtained assets.

They understand that offshore financial institutions can be incredibly effective places for possessions; as strongholds for funds in requirement of secure, protected, discretion. And check here also, they recognize that these banks can protect their funds.